(iTers News) - The unstoppable shifts in consumer demand played havoc on the PC shipments in Europe, the Middle East, and Africa (EMEA). The EMEA regions suffered a 20.2% year-on-year decline in the PC shipments in the first quarter, as consumers dedicate more of their budget to other devices like tablets. Sluggish demand in corporate PC markets took tolls, too, All combined, EMEA PC shipments reached 21.8 million units in the first quarter, with portable PC shipments at 13.6 million, declining 20.6%, and desktops at 8.3 million, down 19.6%.

"While the PC market continues to suffer from a shift to other devices, the current market expansion to a larger product portfolio and higher number of devices per person continues to support an increase in overall spending on total client devices, which grew by 15% in 2012 and will remain at double-digit in 1Q13," said Chrystelle Labesque, research manager, EMEA Personal Computing, IDC.

In Western Europe, PC shipment contraction remained severe, with an overall decrease of 22.5%, and remaining negative for the third consecutive quarter. Almost all countries showed a double digit decline, with southern European countries strongly affected by weakness in consumer markets. The U.K. market held slightly better while Germany performed lower than expected. Tablets and phones continued to capture customer attention and spending while in the corporate space decelerating renewals and the lack or delay in IT investment directly impacted commercial results. The public and education sectors across most countries also remained under pressure, announcing further cuts and austerity measures, adversely impacting PC demand.

"Results fell short of expectations in the consumer segment as softness in demand persisted amid a continued shift to tablets and ongoing budget pressures," said Maciej Gornicki, senior research analyst, IDC EMEA Personal Computing. "Shipments in the commercial market remained constrained as predicted, following continued economic pressure and slowing corporate renewals after two years of Win 7 migrations."

"The PC market experienced a significant decline in both regions Central and Eastern Europe (CEE), and Middle East and Africa (MEA)," said Stefania Lorenz, Associate VP, IDC CEMA Systems. "The PC market recorded a drop of 17.5% year-on-year, reaching just over 10 million unit shipments in 1Q13. The CEE region was the worst affected by market contraction and declined by 20.8% year on year. Desktop and notebook shipments reported over 20% decline respectively. The increasing shift in demand towards tablets is key to the slowdown in the portable market, coupled with constraint from inventory in the largest countries in the region. Performance in the MEA region, on the other hand, was in line with forecasts and contracted by 14% year-on-year. PC demand was also constrained by the growing portion of end users opting for tablets, and when looking at the more mature markets, this trend is evident in the power retail channel, where tablet sales have already exceeded portable PC sales."

Tablets continued to drive most users' attention in the first quarter. The response to Windows 8 remained slow, and the high cost of touch-enabled platforms also constituted an inhibitor to market growth. Tablet adoption is widening after a strong fourth quarter. While consumers are increasingly using tablets for web browsing and emails, tablets are also increasingly entering the commercial space, whether through those users themselves (BYOD), vertical deployments and/or company evaluations. PCs are expected to remain a key platform for creation and productivity, whereas tablets are currently taking over in the consumption area. This evolution implies a major change in usage patterns across both consumer and business segments, which, coupled with macro-economic conditions, are leading to longer replacement cycles for portables and desktops.

"The PC market is in a transition phase with a larger than ever choice in devices, form factors, and various operating system options. While apps, design, and branding but also prices in many cases, drive consumer choice, the commercial sector is carefully evaluating all those new options. New notebook technologies such as touch or ultrabook generate a lot of interest and traction, but high price points prompt many consumers or businesses to hold onto their current system longer," said Chrystelle Labesque.

Windows 8 was part of that dynamic during the first quarter — even though the uptake has not yet delivered the hoped for boost in PC sales. Most of the devices sold in the consumer market are Windows 8 while the uptake in the SMB and corporate space is slow as most companies had already transitioned to Windows 7. At the same time Chromebook notebooks increasingly start to appear in Europe, though the level of sales remained modest in 1Q13.

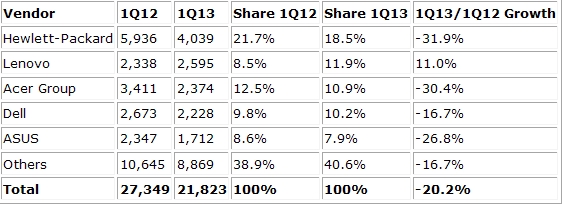

Vendor Highlights

HP maintained a strong lead in EMEA, though with a significant shipment contraction as it was directly impacted by weak consumer demand and an unfavorable year-on-year comparison with a strong first quarter of 2012 related to delayed shipments from 4Q11 due to HDD shortages. Performance was soft in all three subregions with a priority given to tight inventory management while preparing the transition to several new product launches and a strong upcoming product line across both consumer and commercial markets.

Lenovo consolidated its second place in the overall EMEA ranking and remained the only vendor among the top 5 posting growth in a depressed market. The vendor's shipments were up 11%, representing 11.9% market share in EMEA, and gaining share across all subregions. Lenovo's growth continues to be driven by consumer expansion in key geographies, while maintaining a strong focus in the commercial market.

Acer ranked third, directly impacted, as most vendors, by the weakness in the consumer market across the region. The vendor however continued to place attractively positioned products, ultra slim notebooks in particular, while investing further in the Tablet space and continuing to extend its product portfolio. Acer benefited from a good adoption of touch-enabled portable PCs in comparison to a slow market uptake overall.

Dell regained fourth position in the overall ranking in comparison to previous quarter. Albeit recording shipment contraction, the vendor performed better than the market. The limited exposure to the consumer market turned to Dell's advantage this quarter, while overall performance reflected cautious business investment levels.

Asus moved to fifth place with a double-digit decline in shipments, directly impacted by a decline in portable PC sales. Lackluster consumer demand for notebooks directly impacted the vendor's performance from a year-on-year growth perspective. Asus continued to drive incremental growth in the desktop space, however.

Outside the top 5 vendors, Samsung kept sixth place in the overall EMEA ranking, with a decline of 7.1%, gaining market share. Toshiba also maintained its seventh position with a better than market performance supported by a good product line up. Apple suffered from consumer demand weakness while supply constraints from the previous quarter resolved during the quarter. Fujitsu regained one place in comparison to the fourth quarter with a decline in line with the market. Sony also held well, declining only by 1.9% and benefiting from a weak first quarter last year.

Top 5 Vendors: Europe, Middle East, and Africa (EMEA) PC Shipments* 1Q13 (Preliminary) (000 Units)

*PC shipments = desktop and notebooks

(Credit : IDC)