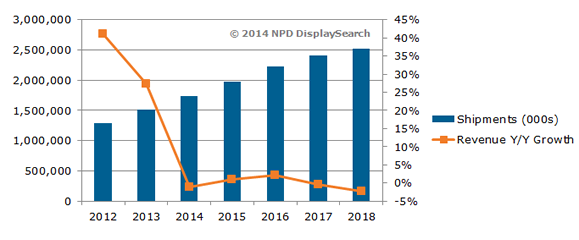

(iTers News) - Although growth in the global smartphone and tablet PC markets continues to drive demand for touch panels, touch module makers are now facing greater competition, which is leading to revenue declines for the first time in four years. According to the NPD DisplaySearch Quarterly Touch Panel Market Analysis, 2013 touch panel shipments increased 17% and revenue increased 27% Y/Y. However, 2014 revenues are expected to decline 1%, while shipments are forecast to rise 15%.

“Increased competition among the growing number of touch-panel makers is causing overall ASP and revenue declines, even as shipment volumes continue their upward trajectory,” said Calvin Hsieh, research director for NPD DisplaySearch. “Some touch module makers will not survive the coming shakeout, but others are already preparing for new opportunities, including increasing production of new indium tin oxide (ITO) replacement materials.”

Figure 1: Touch Panel Shipments and Revenue Growth

Source: NPD DisplaySearch Quarterly Touch Panel Market Analysis

Supply gluts on lagging sales of notebook PCs and AIO PCs

Weak demand for touch-enabled notebook PCs and all-in-one PCs, has caused an oversupply of large touch modules (especially OGS), resulting in a 50% Y/Y decline in ASPs between Q1’13 and Q1’14. Although touch module shipments for notebook PCs grew 362% in 2013, 2014 growth is expected to fall to 22% Y/Y, as only 15% of notebook PCs are expected to ship with touch screens.

“Unless applications for 10" and larger screens can grow faster to create a new and growing market, it is inevitable that touch module makers will continue to compete fiercely, which will lower ASPs and revenues in the smartphone and tablet PC markets,” according to Hsieh. “Windows 8 has not convinced end users to pay the premium for touch screen use.”

(Credit: NPD DisplaySearch)