(iTers News) - The flash flood of low-cost smart phone has just begun in China, and will not lift up every boat. Chinese smart phone makers will most benefit from the proliferation of low-cost smart phones, shaing up the competitive landscape.

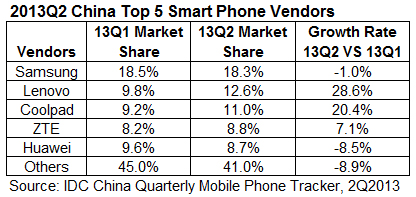

Top-tier smart phone brands like Samsung and Apple will want their piece of the pie, too, turning up the heats in the already hype-competitive Chinese smart phone market. Signs of the shake-out have already surfaced. Samsung Electronics still ranked hottest-seller in the Chinese smartphone market with a 18.3% share in the 2nd quarter of 2013, but suffered from 0.1% drop in shipments quarter-on-quarter, according market research firm IDC. Lenovo made huge headways, making up 12.6% of the market, a whopping jump from a 9.8% share in the first quarter, seeing its shipments to leap forward by 28.6% quarter-on-quarter.

According to market research IDC, shipments of smart phones made up more than 80% of China’s total mobile phone shipments, reaching 86 million units in the second quarter of 2013. It marks a 10% jump from the previous quarter.

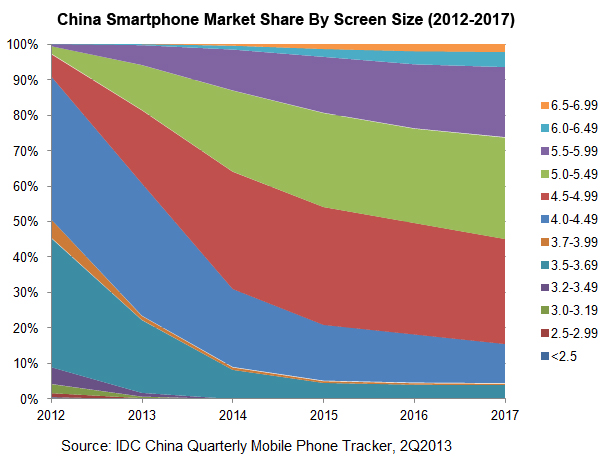

Booming demand for low-cost smart phones, which sell for less than RMB 800, was the biggest growth driver.

Low-cost smart phones on the prowl

Shipments of mobile phones hit 110 million in the 2nd quarter.

“The smartphone market has maintained a two-digit quarter-on-quarter growth rate in Q2 due to two reasons. First, the substantial shipments of low-end smartphones at a unit price of less than RMB 800 that support China Mobile’s 3G network. Second, the shipments prepared by mobile phone vendors to meet the market demands of students during the summer vacation,” says Antonio Wang, associate director for Client System Research, Imaging, Printing & Document Solution Research, Research Operation Center, IDC China.

"The sharp increase in shipments of low-end China Mobile smartphones has driven the growth of Lenovo and Coolpad. On a separate note, affected by the sluggish sales of iPhone 5, Apple’s market share has declined dramatically, but its performance is expected to remarkably improve with the launch of the new iPhone,” says James Yan, Senior Analyst for China Mobile Phone Market, IDC China.

4G LTE buoys up demand

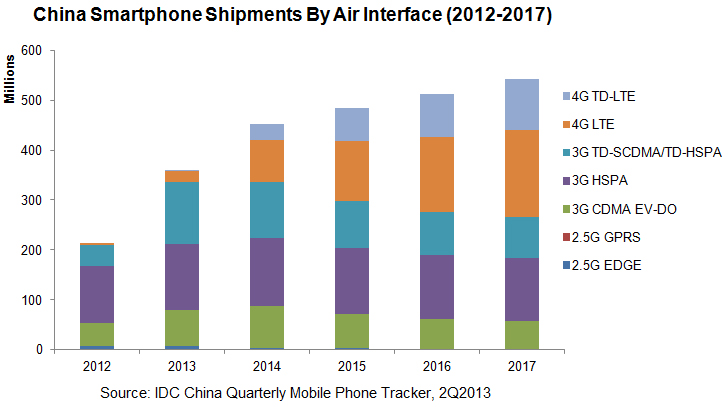

For all of the fiscal 2013, IDC forecasts China’s smartphone shipments would hit 360 million units, mainly driven by service carriers’ subsidies and consumers’ strong replacement demand to upgrade their mobile phones

The rapid proliferation of 4G KTE technology will buoy up the boat.

With the issuance of 4G licenses and the launch of Apple's new iPhones by China Mobile, IDC expects China’s smartphone shipments to exceed 450 million in 2014, including 120 million smartphones that would support 4G functions and over 32 million smartphones that would adopt China Mobile’s TD-LTE air interface.

That would benefit the upstream 4G chip and screen vendors, midstream mobile phone vendors and APP developers, and channel distributors and accessory vendors, which would in turn, accelerate other innovations in the mobile communication and Internet industry.

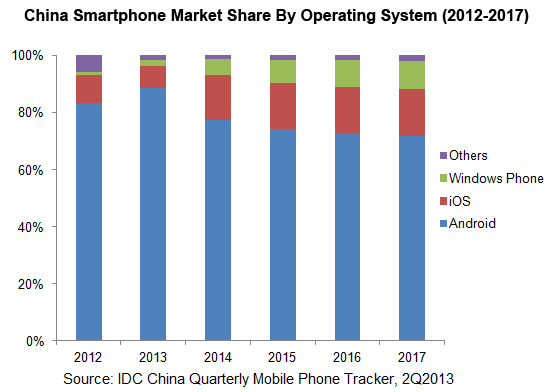

To compete with the flood of Chinese low-cost smart phones, Apple Inc. already came up with low-cost, budget-priced iPhone 4c. As smart phone markets in matured economies are getting increasingly saturated, China is where the next and final wave of growth lies ahead. Every brand knows it , and has geared up for the final showdown.