As those power electronics markets are poised to take off, demand for high frequency and high voltage power management and power supply chips are on the rise.

This new market requirements will likely spur demand for silicon IGBT, Super Junction (SJ) MOSFETs, Gllium Nitride (GaN) and Silicon Carbide (SiC) -based devices, market research and consulting firm Yole Development predicts.

According to Yole Development, IGBTs are expected to account for US$1.6 billion in the medium to high voltage sector, while SJ MOSFETs are estimated to reach US$567 million by the end of 2012.

While global market revenue for SiC-based semiconductor devices will represent only 1% of the total market for semiconductor devices, the SiC sector is forecasted to grow 37% per year to reach US$5.34 billion by the end of the next decade through aggressive market penetration, Yole Developpement predicts.

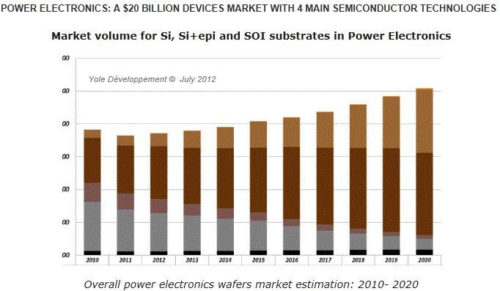

In 2012, the market for purely power electronics industry-dedicated IC chips will reach US$20 billion, including, discretes, modules, and ICs.

With applications as diversified as hybrid cars, PV inverters, lighting, energy, and voltage ranging from a few volts to a few thousands volts, power electronics is and will remain one of the most attractive and most coveted market segment of the semiconductor industry over the next decade.

Shake-up in competitive landscape

Lured by such high market potential, newcomers are now jumping on the bandwagon. Or, established makers are in a rush to consolidate their capacity to get strong enough economies of scale to undercut competitors on costs.

SJ MOSFETs see new players and foundry service suppliers, the IGBT dies' industry is getting consolidated by the presence of large players involved in many applications, such as Infineon, Mitsubishi Electric and Fuji.

However, IGBT (and SJ MOSFET) modules business is increasing and an array of new players are sprouting up provide solutions for cooling, interconnections, substrates, packaging, and gel.

On the other hand, the SiC industry, which has been led by CREE, is now another magnet for newcomers.

With access to lower cost material, the SiC industry now has the possibility to ramp up and get organized.

However, apart from the PFC business, technological capabilities of SiC show that it will surely be dedicated to high power/voltage applications. Last but not least, SiC companies have appeared in China, which will eventually flare up competition and enjoy privileged access to local Chinese markets.