Cymer, Inc. reported a net profit of US$9.6 million on revenue of US$149.3 million in the second quarter of fiscal 2012 ended on June 30. The 2nd quarter net income was more than halved from a net income of US$21.5 million in the 1st quarter, but the 2nd quarter revenue was just slightly below US$150.5 million in the 1st quarter revenue.

R&D expenses of US$50.28 million are mainly blamed for such big deteriorations in the 2nd quarter profitability.

Commenting on the 2nd quarter results, Bob Akins, Cymer's chief executive officer, said, "The second quarter of 2012 was an active and productive quarter. Our deep ultraviolet (DUV) light source shipments grew from the prior quarter, as we continued to satisfy requests for increased customer demand.”

DUV backlog order of US$ 69 million

“Our extreme ultraviolet (EUV) source development and commercialization progress continued, as we demonstrated improved expose power performance using prepulse and we realized significant improvement in extending collector lifetimes and the viability of collector refurbishment. We also began the integration and testing of our first EUV 3300 source. In addition, we completed qualification and customer acceptance of our first TCZ Gen 5 crystallization system, and entered into our first multi-year TCZ OnPulse agreement," added he,

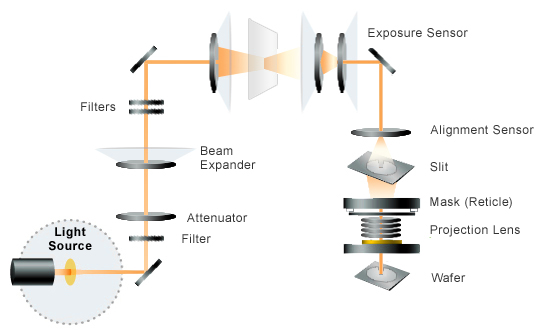

The EUV is the next generation of light source to etch a fine pitch of below 20nanometer geometry on a silicon wafer. The shorter the wavelength of the light source, the narrower the pitch gets, allowing chipmakers to go below a 20nm gate circuitry.

According to the semiconductor equipment maker, the company shipped 36 DUV, or deep ultra violet light sources in the second quarter. Of total, 20 were ArF(argon-fluoride) immersion, 2 were ArF dry and 14 were KrF, and the company said it installed 31 DUV light sources at chipmaker locations.

As a result, its gross profit was US$$78.8 million for the 2nd quarter of 2012, yielding a 52.8% gross margin. However, its total operating expenses were US$67.6 million, including research development and currency transaction losses. .

DUV and Installed Base Products (IBP) bookings for the 2nd quarter of 2012 totaled US$154.7 million, resulting in a book-to-bill ratio of 1.09. 60% of the DUV unit bookings were ArF immersion, and 32% were KrF. The company ended the quarter with a DUV backlog of approximately US$69.0 million.

EUV3300 to be shipped in the 3rd Q

He offered the revenue guidance for the third quarter of 2012, forecasting that the 3rd quarter revenue would be approximately the same as the 2nd quarter, while its gross margin would hit 52%. The company plans to spend US$57 million on its R&D projects in the 3rd quarter.