In a desperate need for new streams of revenues, a couple of Korea fabless chip makers are turning to silicon carbide, or SiC-based power chips for their future. So are raw material and equipment makers, joining in to expand the ecosystem for rugged application markets like cars and telecommunications and industrial equipment.

Made of silicon carbide, SiC-based power IC chips are so highly resistant to high temperature and high pressures that they are mainly used with power devises in cars and telecommunications gear.

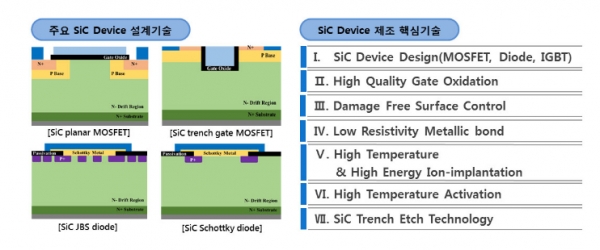

Rohm Semiconductor of Japan and Infineon Technologies are major legacy chip makers in the market, producing a range of power IC chips like MOSFET, IGBT, and diodes.

As car market promises to grow faster than ever before, however, Korean newcomers are jumping on the bandwagon to catch up with market leaders. Especailly for Korean fabless chipmakers , who have lbeen suffering from notoriously fickle demand in consumer applications market like smart phones and PCs, the SiC market looks attractive, as it guarantees stable growth.

Cases in point are TRINNO Technology, AUK, and Yes PowerTechnix.

Known as a subsidiary of IA Innovation, TRINNO Technology has just shipped sample of SiC-based power IC chips for cars. The company plans to start commercial production of high-voltage SiC-based power IC chips foe EVs by 2020. On the way toward that goal, its parent IA Innovation has established a joint-venture production base with Zhangjiagang City government in Zhangjiagang, Jiangsu Province, China to churn out SiC power IC chips.

PowerTechnix has invested 20 billion won to establish a dedicated production line for SiC power IC devices and is now fabricating them in high volume zeroing on white goods, solar cells, and EV battery charge markets.

According to some estimates, global SiC power device IC chip market is worth US$20.7 billion, growing at an annual average growth rate of 8%. Korea’s domestic market alone amounts to 2.7 trillion won, of which 90% is supplied by imports, as ROHM, Infineon, Toshiba, and STMicroelectronics are collectively dominating the market. The entry of domestic chip makers into the market is also encouraging domestic raw materials and equipment makers to join the production ecosystem.

Attracting about 4.9 trillion won from Tokyo Electron, Hana Materials is expanding its reach into SiC chip equipment parts and components market, working on development on ESC Chuck and SiC rings for CVD equipment.

TCK, or Tokai Carbon Korea, a joint-venture between TOKAI Carbon and K.C .Tech, is producing solid SiC wafers and SiC rings. TCK started its business in 2000