Santa Clara, Calif.( NPD DisplaySearch )__Apple shipped nearly 17.2 million mobile PCs in Q1’12, accounting for 118% Y/Y shipment growth, according to preliminary results from the latest NPD DisplaySearch Quarterly Mobile PC Shipment and Forecast Report. Nearly 80% of Apple’s mobile PC shipments were iPads, which reached over 13.6 million units in the quarter, for 162% Y/Y growth.

Total mobile PC shipments in Q1’12 were 76.2 million units, a seasonal drop of 15% compared to Q4’11. Shipments grew 30% Y/Y, with tablet PCs growing 124% Y/Y and notebooks and mini-notes growing 12%.

From the regional perspective, the China market stood out with Q/Q shipment growth. “The China region had sequential quarter shipment growth, achieving 13% for mobile PCs overall, 12% for notebook and mini-note PCs, and 16% for tablet PCs,” said Richard Shim, NPD DisplaySearch Senior Analyst. “This is noteworthy given the sequential declines in all other regions as well as the declines in other product categories including TVs and monitors.”

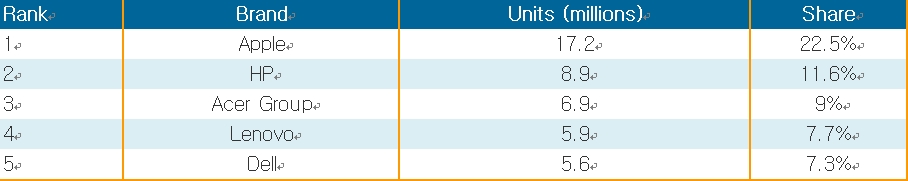

Tablets fueled Apple’s mobile PC growth, enabling the company to reach 22.5% share in Q1’12, nearly twice HP’s share. The other brands in the top five relied on notebook PC shipments to establish their positions.

Table 1: Preliminary Q1’12 Worldwide Top Five Mobile PC Shipment Rankings by Brand

Source: NPD DisplaySearch Q2’12 Quarterly Mobile PC Shipment and Forecast Report

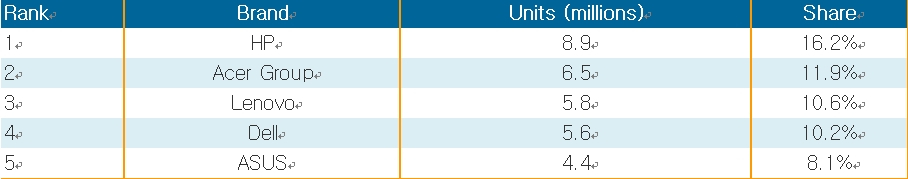

In the notebook and mini-note PC market, many of the top brands took a conservative stance on shipments, opting to focus on margins and profits as opposed to market share. HP was one of the few top players in the market to increase its unit shipments Y/Y, by nearly 700,000 units. HP maintained the top notebook and mini-note PC ranking with 16.2% share, although it lost some ground in EMEA with shipments down 17% Y/Y. Acer took the number two position, capturing 11.9% share, with 6.5 million units. While China was a key region for Acer in the quarter, Lenovo was the chief beneficiary of the China region’s strong shipment growth. Lenovo also gained ground in North America. Dell lost share to Lenovo as it continued its focus on the commercial market segment. ASUS was the most aggressive of the top five players in the notebook and mini-note market, gaining significant share in all regions, as it recovered after weak Q4 shipments.

Table 2: Preliminary Q1’12 Worldwide Top Five Notebook and Mini-Note PC Shipment Rankings by Brand

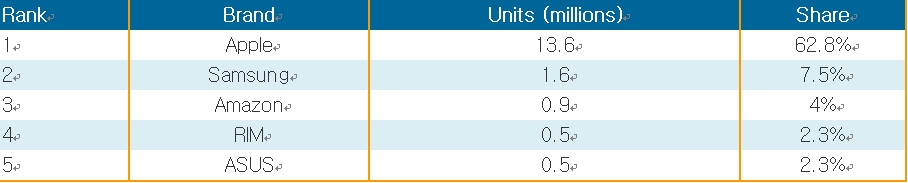

Apple continued its dominance of the tablet PC market, capturing 62.8% share in Q1’12. Barnes & Noble fell out of the top five. Amazon managed to hold on, but fell to #3 from #2. Samsung regained the #2 spot with its strongest results in EMEA. RIM and ASUS jumped back into the top five rankings after weak results in the previous quarter.

Table 3: Preliminary Q1’12 Worldwide Top Five Tablet PC Shipment Rankings by Brand

The NPD DisplaySearch Quarterly Mobile PC Shipment and Forecast Report covers the entire range of mobile PC products shipped worldwide and regionally. With analysis of global and regional brands, the report provides an objective, expert view of the market with insight into historical shipments, revenues, forecasts and more.