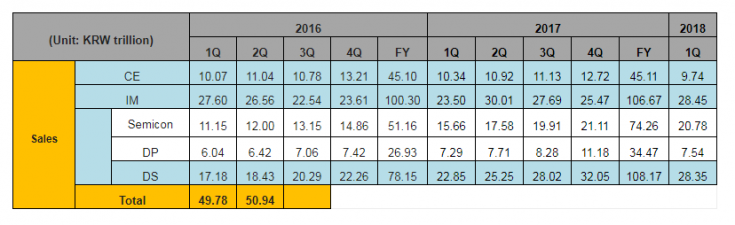

The world’s largest memory chip and smart phone maker today reported an operating profit of 15.63 trillion won, 3.2% up quarter-on-quarter in the first quarter on consolidated revenue of 60.56 trillion, which were down 8.2% from a quarter ago.

The first quarter marked the first quarter-on-quarter drop in the revenue in 3 quarters, reflecting low seasonality across a broad range of IT devices from mobile phones to TVs.

Yet, Samsung has remained less susceptible to the low seasonality than other, as its semiconductor chip business successfully recouped setbacks in other sectors.

Its semiconductor chip business chalked up revenue of 20.78 trillion won, 1% down quarter-on-quarter, but its operating profit jumped by 5.96% from a quarter ago to 11.5 trillion won, mainly driven by booming sales to high-end sever markets of graphics DRAM and high-performance DRAM and NAND chips, which offset slumps in the shipments to mobile phone market.

The semiconductor chip business accounts for 73.8% of Samsung’s total operating profit, as its memory chip, foundry and SoC solution business performed better than expected. Especially, its foundry chip business rode to new highs booming orders from GPU, or graphic processor unit fabless chip makers like Nvidia, which are key technology in mining Block chain-based digital crypto-currencies like Bit-coin.

Solid sales of flagship smart phone models emerged as another contributor, seeing big jumps both in revenues and profits.

Reflecting robust shipments of flagship smart phone models, Samsung’s IM or IT and mobile business unit reported 11.0% and 55.8% jumps quarter-on quarter in the revenues and operating profits to 28.45 trillion won and 3.77 trillion won, respectively.

Yet, its consumer electronics and display business units suffered low seasonality. Its display panel business was hard hit by sluggish shipment of OLED panels to Apple Inc., seeing 32.5% and 71% drops quarter-on-quarter in the revenues and operating profit to 7.54 trillion won and 410 billion won, respectively.

Low seasonality demand for LCD panels played havocs with the poor performances, too.

Its consumer electronics division suffered from 23.4% and 45% quarter-on-quarter drops in the revenues and operating profits to 9.74 trillion won and 280 billion won, respectively. The first quarter is typical of slow seasonality season for TVs and other consumer electronics makers.

Looking forward, Samsung expects that the 2nd quarter performances will not likely to be better off than in the first quarter, blaming sluggish demand for display panels as well as deteriorations in the profitability of the mobile businesses.

Yet, memory chips will come stronger, as mobile, graphics and server market-bound DRAM demand will keep their growth momentum up and running even in the second quarter and beyond. Solid recovery in the prices of NAND flash memory chips are also in the pipeline, boosting sales and profitability.

Samsung has invested 8.6 trillion won in the CAPEX in the first quarter, of which 7.2 trillion won went to the semiconductor business. About remaining 800 billion won was invested to build capacity for display panels like OLEDs.

※ Consolidated Sales and Operating Profit by Segment based on K-IFRS (2016~2018 1Q)