Riding on the coattails of booming demand for memory chips, the world’ largest memory chip and smart phone maker today reported an operating profit of 9.22 trillion won, a whopping 50.11 % jump year-on-year in the fourth quarter of fiscal 2016 ended on Dec. 31. 2016. The 4th quarter operating profit turned out to be the third largest ever. The record-high operating profit also demonstrates to how such degree Samsung’s business portfolio gets diversified that each business sector complement each other by recouping setbacks in one with gains in others.

The consolidated revenue edged up 0.33% year-on-year to a record-high of 53.33 trillion won.

The strong U.S dollar against the Korean won partly helped lift up the profitability, as the strong dollar bloated its Korean won-denominated earnings results.

Yet, that’s a small part of the big picture. Samsung’s semiconductor chip business was a real money spinner that helped the company weather out troubles at its mobile phone business.

The business unit logged an operating profit of 4.95 trillion won, up 76.7% up year on year, on revenues of 14.86 trillion won, which was also 12% up from a year ago.

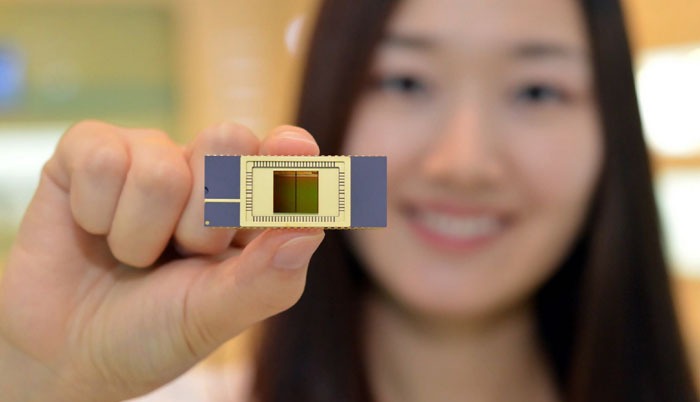

Booming demand for DRAM chips and 3D NAND flash memory chips played the biggest part in the growth picture, as Big Data Analytics, floods of 4K and full HD videos and still images are guzzling up data storage spaces across a wide spectrum of devices from smart phones to data center servers to cloud computing network.

Hungry for storage spaces, more and more of devices are being built with more of memory chips like 3D NAND flash memory chips and DRAM. For example, smart phones are getting increasingly sophisticated so that they carry 4GB memory storage spaces on average, double the average of 2GB in the past.

That proves big boon for Samsung’s memory chip business, because the chip maker can afford to outperform other rivals in scale and capacity as well as chip portfolio, which allows it to skim off the most lucrative part of the market.

When it comes to its System LSI business, the chip maker also fare well shipping mid-to-low end mobile AP, image sensors, and DDIs in bi quantities.

Its ramp-up to the industry’s first 10-nm FinFET process allows it to undercut other foundry rivals on costs.

Its display panel business also was beneficiary of the smart phone sophistication and commoditization.

As smart phones get commodity, but go upscale in features and specs, OLED panels are increasing becoming standard norms, or fixtures. The commoditization The business unit chalked up an operating profit of 1.34 trillion won, up 77.6% year-on-year, on revenues of 7.42 trillion won, which was 13.6% up year-on-year.

Yet, the commoditization of smart phones took tolls on its IT & mobile communications, or IM business. The division posted reported an operating profit of 2.50 trillion won, recovering from an operating profit of 100 billion won in the 3rd quarter when it got embroiled into the fire scandal of its Galaxy note 7 smart phone, but its revenue was 6% down year-on-year to 23.61 trillion won.

The fourth quarter saw higher market demand for smartphones and tablets riding on year-end peak seasonality.

The Mobile business saw its earnings increase YOY on the back of continued robust sales of the flagship Galaxy S7 and S7 edge as well as improved profitability in the mid-to-low end segment.

Looking ahead to 2017, while slow growth in smartphone demand is forecast, new services such as AI are expected to be differentiating factors for the industry this year.