(iTers News) - Telecom market research firm Infonetics Research released excerpts from its latest Small Cell Equipment market size and forecast report, which tracks 3G microcells, picocells, and metrocells and LTE mini eNodeBs and metrocells.

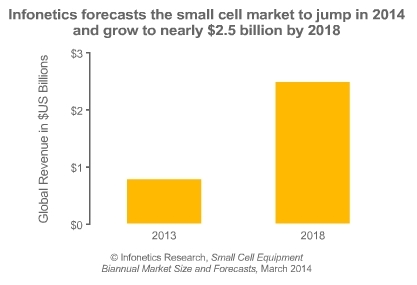

“As we anticipated, the great small cell ramp did not happen in 2013 as many in the industry had hoped. Testing activity remained solid, but actual deployments were modest. Small cell revenue was just US$771 million last year, a sharp contrast to the US$24 billion 2G/3G RAN market,” reports Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics and co-author of the report, adds: “Nevertheless, the need to enhance existing saturated macrocellular networks that are struggling to maintain a decent mobile broadband experience, as well as to add capacity to existing LTE networks, is bringing some fuel to our forecast and, consequently, we expect the small cell market to grow 65% by year’s end, when it will reach US$1.3 billion.”

SMALL CELL MARKET HIGHLIGHTS

- As mobile operators have to approach a “critical mass” of data traffic before small cells even become a consideration, it is the developed countries (Japan, South Korea, the UK and US) that are driving early adoption

- 642,000 small cell units shipped in 2013, a 143% spike from 2012; over half of these units are of the 3G variety

- However, starting this year, 4G metrocells will close the gap with 3G, becoming the main growth engine

- Backhaul is no longer a major inhibitor to small cell deployment, but it will remain an issue for some mobile operators due to the locations in which they operate

- 5G is coming, fully loaded with small cells: NTT DOCOMO in Japan plans to have 5G commercially available in 2020, in time for the Tokyo Olympics

(Credit: Infonetics Research)