(iTers News) - When it comes to shipments of 4K TV display panels, Taiwan is second to none. Supplying much of world’s largest and fastest-growing Chinese 4K TV market, Taiwanese LCD panel makers will lead global 4K TV panel shipments in 2014.

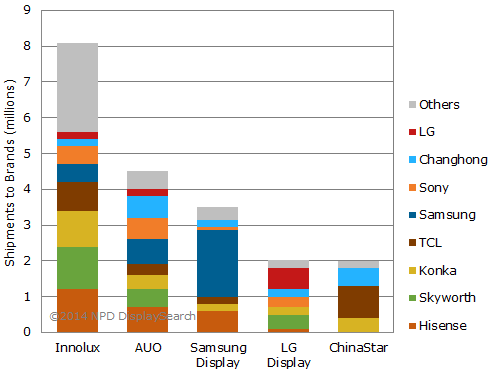

According to market research firm NPD DisplaySearch, Taiwanese panel makers Innolux and AUO are forecast to collectively represent 58% of the global 4K shipments in 2014, followed by Korean manufacturers’ 25% combined -Samsung Display and LG Display.

Chinese LCD panel manufacturers will account for 14%, as ChinaStar and BOE are rapidly ramping up their production.

True enough, China is the world’s fastest-growing 4K TV market, as Chinese top 6 TV makers are aggressively trumpeting 4K picture quality as future-proof TV features to drum up 4K TV sales in their home-turf.

Their strategy is straightforward. The economies of scale in their home market will give them an unparalleled opportunity to preempt global 4K TV market.

The biggest beneficiaries of the Chinese TV makers’ aggressive rollouts of 4K TVs are Chinese panel makers -ChinaStar and BOE.

Taiwanese LCD panel makers will likely more benefit than Korean LCD panel makers.

For example, about 90% of ChinaStar’s 4K TV panels go to China’s top six brands, while BOE supply 70% of its 4K panel output. Meanwhile, Taiwanese LCD panel maker Innolux ships 57% of its 4K LCD panel production to the top 6 Chinese TV makers, while AUO supplies 56%.

World’s two largest LCD panel makers -Samsung Display and LG Display—have yet to carve out significant niches in the Chinese 4K TV panel market, however. They are mainly concentrating most of their 4K production resources to supply their captive markets –Samsung Electronics and LG Electronics.

According to NPD DisplaySearch, Samsung Electronics and LG Electronics each plan to source about 60% of their 4K TV panels from their in-house panel manufacturers this year.

“The 4K display demand from their related TV brands is critical to the ability of Samsung Display and LG Display to compete effectively within the growing 4K TV market,” said Deborah Yang, research director for monitors and TV for DisplaySearch. “The ability of the Korean panel makers to expand 4K panel production is dependent on their success in securing more 4K display clients, beyond satisfying the needs of their own 4K TV brands.”

“The rise of the 4K TV market is mainly driven by the supply side, while leading TV brands are concerned about the value proposition of 4K TVs,” Yang said. “While some TV brands are considering increasing their 4K TV shipment targets, we continue to see a mismatch between 4K TV panel supply plans and consumer purchasing expectations.”