(iTers News) - After a decline in the second quarter of 2013 and a tepid expansion in the third, demand for touch-screen panels used in notebook PCs is set to rebound to double-digit growth during the last three months of the year.

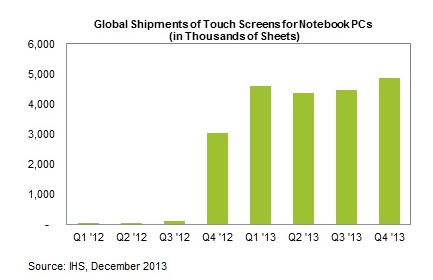

Shipments of touch panels for notebooks will amount to 4.9 million sheets in the fourth quarter, up 10% from 4.4 million in the third quarter, according to data from the “Touch Panel Shipments Database – Notebook” report from IHS Inc.. This follows a marginal 2% increase in the third quarter and a 5% drop in the second, as presented in the attached figure.

“While the overall notebook PC market remains sluggish, sales of touch panels for notebook PCs are showing some signs of life in the fourth quarter,” said Stone Wu, principal analyst for display components and materials at IHS. “The resumption of double-digit growth is being driven by the full-scale launch of 10.1-inch touch-screen panels that appeal to consumers, along with the introduction of a new microprocessor solution and the arrival of exciting new form factors.”

A touch-and-go market

Despite the growth in the second half of the year, demand for laptops with touch panels is falling short of expectations in 2013. Overall shipments of notebooks have been weak this year because of the continuing inroads of media tablets into consumer demand. This has slowed growth even in the hot touch-screen notebook segment.

However, even with the disappointing growth, shipments of notebook touchscreen panels will rise to 18.2 million sheets in 2013, up nearly 500% from 3.2 million in 2012. This makes touch-screen notebooks the fastest-growing segment of the PC market today.

Wintel to the rescue

The notebook touch-screen panel market in the second half has been boosted by the launch of products based on the new low-power Atom Bay Trail central processing unit (CPU) chip from Intel Corp.

The market also is getting a lift from the release of two-in-one convertible form-factor notebooks that have detachable displays.

Shipments of notebook touch-screen panels that are smaller than 10.1 inches are expected to flourish in the near term thanks to heavy subsidies to be provided by Intel and Microsoft for laptops with touch-screen panels and utilizing the Atom chip or the Windows 8.1 operating system.

Third-quarter woes

Even with the rise in shipments in the third quarter, the notebook touch-screen panel market dwindled in terms of shipment area and revenue compared to the second quarter.

The average shipments area per unit in the third quarter was 0.065 square meters (sqm), or 4.1% smaller than the 0.068 sqm of the second quarter.

Market revenue for notebook touch-screen panels came to US$190.2 million, down 12.8% from the second quarter. Pricing was impacted by an oversupply of panels, particularly in the large-sized laptop market.

In terms of form factors for notebooks with touch-screen panels, the most prominent change in the third quarter was the decrease in clamshell types, with their share of market shipments falling to 63.4%, down from 75.2% in the second quarter. Meanwhile, the detachable segment rose to 16.9%, up from 11.5%. Tablet form-factor types rose to 12.7%, up from 5.5%.

Much of the growth in the detachable and tablet form factors is attributed to the heavy subsidies originating from Intel and Microsoft.

(Credit: IHS iSuppli)