(iTers News) - NBCUniversal leads the US TV Everywhere (TVE) effort in providing access to TV content on second screens like smartphones and tablets, while EPIX and HBO share the distinction of supporting TVE on more second-screen devices than any other premium or basic cable network, according to a new report from the TV Intelligence Service at IHS Inc..

NBCUniversal provides TVE in 15 of its 18 channels, or 83% of the studio’s total stable of cable and broadcast networks to pay-TV subscribers willing to authenticate on second-screen devices. Meanwhile, EPIX and HBO have been at the forefront of the TVE experience, with both very willing to embrace new technologies and offering significant amounts of content on their apps and portals.

EPIX first kicked off the TVE phenomena in October 2009, formed by partners Paramount, MGM and Lionsgate after their failed renewal with Showtime HBO followed suit in February 2010 with the launch of its web portal and how has a vast TVE library online, even though it does not yet offer live linear streaming.

HBO, along with Cinemax and BTN2Go, are the only three networks to have TV Everywhere authentication agreements with all major US pay TV operators.

For its part, Showtime is the only premium network offering live linear streaming through TV Everywhere. The company is also allowing for authentication outside of the home, a feature likely to expand to other basic and premium cable networks as TVE continues to evolve.

The last premium channel group to the party is Liberty’s STARZ. STARZ and Encore launched TV Everywhere services in October of 2012, but are still missing authentication deals with both Comcast and DISH Network.

One entity so far remains the lone hold-out among the major channel groups not providing any TV Everywhere content—Discovery Communications. But that will change as Discovery is expected to finally jump into the fray in the near to midterm time frame. It will likely become critical to offer similar services, IHS believes, as TVE access becomes more central to the future of US pay TV video.

Solving the cord-cutting problem before it gathers steam

All major pay-TV operators to date have implemented some form of the TVE service, although sometimes in very limited form, via either live linear streaming or video on demand (VoD). But while the streaming of live linear network feeds is largely relegated to in-home use, video on demand (VoD) is a significant out-of-home TVE product.

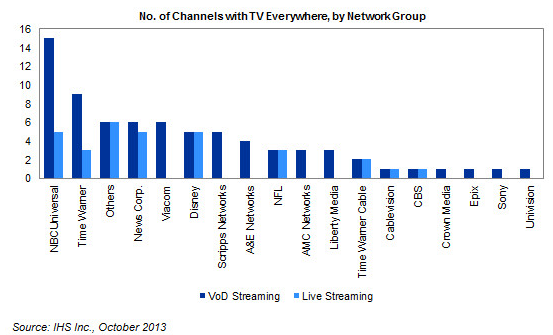

VoD streaming channels, at 73 including cable, premium and broadcast, far outnumber the channels offering live streaming, at 31, as shown in the attached figure. NBCUniversal, the TVE leader, has 15 VoD channels and five live streaming channels, followed by Time Warner with nine VoD channels and three live streaming channels.

“TV Everywhere has been developed as a collective strategy by both pay-TV operators and TV content owners to enhance the traditional linear TV proposition, so that secondary screens like tablets and smartphones can be used to view TV content in addition to the primary screen,” said Erik Brannon, analyst for U.S. cable networks at IHS. “And in spite of the differences in strategy, all TVE products have one thing in common: They allow for current pay-TV video subscribers to authenticate and consume on secondary screens a significant amount of content that they purchase as part of their normal pay-TV video subscriptions.”

TVE is one approach that pay-TV operators and network owners are using to stem the tide of cord-cutting among cable subscribers before the number of defections become significant. In many cases, cable subscribers are finding themselves increasingly tempted to end their subscriptions—either because of high costs or because of other alternatives now available, such as over-the-top (OTT) alternatives like Netflix. In the second quarter of 2013 alone IHS estimates that the pay-TV business shed 352,000 subscribers, mostly to seasonality, but some elements of cord-cutting are likely to have been present as well. To be sure, the combined price of US$28 (Netflix, Hulu Plus and Aereo) may be more appealing to consumers than the US$80+ average revenue per user that IHS estimates pay-TV video customers will pony up for service in 2013.

Through TVE, both pay-TV operators and network owners hope to add new functionality and interactivity to the television viewing experience. And by partnering with pay-TV operators, content owners like the broadcast networks hope they can continue to solidify their hold on the distribution of premium television content.

Device compatibility extending beyond iOS and Android

TV Everywhere is also evolving beyond Apple iOS and Android, the two platforms on which TVE apps first appeared. Now, TVE apps from networks are becoming available and are being deployed across a wide range of connected devices, including smart TVs; video game consoles like Microsoft’s Xbox; Amazon’s Kindle Fire; Blu-ray players; and digital media products such as Roku and Apple TV.

Adoption of TVE initiatives by the major channels is a reaction to the changing landscape of TV viewers in the country, Brannon noted. And as it continues to grow in awareness and popularity, TV Everywhere will remain a central focus for pay-TV operators.