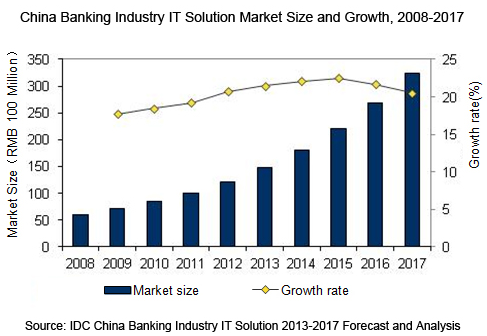

(iTers News) – IDC is expecting China’s banking industry IT solution market to grow at a compound annual growth rate (CAGR) of 21.7% from 2013 to 2017 to reach RMB 32.44 billion in 2017, 9.6% higher than that of China’s entire banking industry IT market.

According to IDC’s report China Banking Industry IT Solution 2013-2017 Forecast and Analysis, the total IT investment of China’s banking industry was RMB 66.96 billion in 2012, and will reach RMB 116.32 billion in 2017, with a CAGR of 12.1% from 2013 to 2017.

China’s banking industry IT solution market reached a total size of RMB 12.17 billion in 2012, an increase of 20.7% compared to 2011 and accounting for 46.5% of the entire bank software and service market.

The year 2012 was a milestone for China's banking industry. The official release of the Twelfth Five-Year Plan on Development and Reform of the Financial Industry laid out a blueprint for the development of China’s financial industry for the next few years.

In addition, the introduction of the Measures for Management of Commercial Bank Capital (trial) opened new capital regulations for China’s banking industry.

The central bank also introduced bidirectional expansion of the floating ranges of deposit and loan interest rates, thus taking China’s interest rate market another step forward.

And in the 18th CPC National Congress, financial reform was identified as a top priority of government work for the next decade.

All these policies laid the foundation for the development of China’s banking industry. As such in 2012, China’s overall banking industry experienced steady development; the banking business and IT were deeply integrated; the importance of technology was more apparent; and the banking industry gradually stepped into a new phase of informationalized bank.

IDC notes that in 2012, China’s banking IT solution market also stepped into an integrated development stage. The privatization of Yucheng, the rising of Pactera after merger with VanceInfo, and UFIDA’s restart and funding of its financial division indicate that the market is entering into a new stage of integrated development. It also signifies that the industry is confident of the market development potential.

Core business systems made up for the bulk of total investment in China’s banking industry IT solution market in 2012. The intermediary business system segment also grew rapidly. As interest rate liberalization accelerates in China’s banking industry, intermediary business systems are the focus of bank transformations.

And in the channel solution market, financial IC card continues to be the core of the market and is becoming the biggest market segment. Electronic channel is a key construction field for the transformation of China’s banking industry and the illustration of the customer-focused concept, and this trend is expected to extend to the future.

In the management class market, the business intelligence market is growing rapidly, and continues to take a leading position in this market.

"Faced with downward pressure from both international and domestic economies, China banking industry IT solution market stepped into an integrated development stage while maintaining overall steady growth in 2012. Besides expanding the market size, solution providers should enhance internal management and standardization; continuously improve user acceptance; accumulate mutual trust with users; and focus on their own sustainable development."

"Compared with users in other industries, bank users pay more attention to service team stability and product maturity. As China’s banking industry undergoes rapid transformation, bank users will pay more attention to product and service innovation in the next few years. Therefore, segments such as intermediary business system, business intelligence, risk management, financial IC card and mobile finance are likely to grow rapidly,” concludes Frank Fang, Senior Research Manager of Vertical Industry Research and Consulting of IDC.

(Credit : IDC)