(iTers News) - Worldwide microprocessor sales are on pace to reach a record-high US$61.0 billion in 2013 mostly due to strong demand for tablet computers and cellphones that connect to the Internet, but the ongoing slump in standard personal computers-including notebook PCs-is once again dragging down overall MPU growth this year. Total microprocessor sales are now expected to increase 8% in 2013 after rising just 2% in 2012, according to a new forecast in IC Insights' Mid-Year Update of The McClean Report 2013.

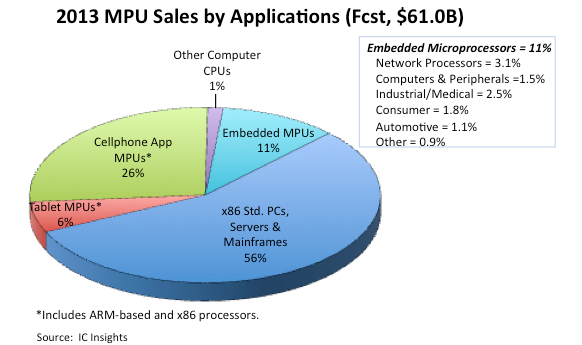

IC Insights’ mid-year forecast trims the marketshare of x86 microprocessors primarily sold by Intel and rival Advanced Micro Devices for PCs and servers to 56% of total MPU sales in 2013 compared to the previous estimate of 58%. Figure 1 shows embedded microprocessors are now expected to account for 11% of MPU sales in 2013 (versus 9% previously), while tablet processors are projected to be 6% of the total (compared to 5% in the original January forecast). The new forecast keeps cellphone application processors at 26% of total MPU sales in 2013 but lowers the marketshare of non-x86 central processing units (CPUs) in computers outside of tablets to 1% (from 2% previously).

The proliferation of multimedia cellphones and the surge in popularity of touch-screen tablet computers are fueling strong double-digit growth rates of MPU sales and unit shipments in these two systems categories. The vast majority of these systems are built with mobile processors based on 32-bit CPU architectures licensed from ARM in the U.K. Many MPU suppliers serve smartphone and tablet applications with the same processor platform design. The falloff in standard PC shipments is a major problem for Intel and AMD since they have supplied more than 95% of the x86-based MPUs used in personal computers since the 1980s.

The new mid-year forecast raises tablet processor sales in 2013 to nearly US$3.5 billion, which is a 54% increase from US$2.3 billion in 2012. Cellphone application processor sales are now expected to grow 30% in 2013 to US$16.1 billion from US$12.4 billion in 2012. At the start of this year, sales of mobile processors in tablet computers and cellphones were forecast to grow 50% and 28%, respectively. Stronger unit shipment growth in mobile processors has lifted the revenue forecast in these MPU market segments.

Figure 1

Meanwhile, the larger market segment of MPUs used in PCs, servers, and embedded-microprocessor applications continues to contract, albeit at a slower rate than in 2012. The mid-year forecast shows sales of MPUs in PCs, servers, large computers, and embedded applications slipping by 1% to US$41.4 billion in 2013 from US$41.9 billion in 2012, when revenues dropped 6%. This large MPU market segment was previously forecast to rebound with sales increasing 5%, but the anticipated bounce back has been blocked by weak shipments of standard PCs, which IC Insights believes will fall by 5% in 2013 to 327 million systems.

While the mid-year outlook lowers total MPU revenues in 2013, it slightly increases the growth in microprocessor unit shipments to 10% this year from a projection of 9% in the January forecast. Total MPU shipments are now expected to reach 2.15 billion devices in 2013, with tablet processors growing 62% to 190 million units and cellphone application processors increasing 11% to 1.50 billion this year. IC Insights’ microprocessor category does not include cellular radio-frequency baseband processors or stand-alone graphics processing units (GPUs), which are counted in the special-purpose logic/MPR category of the IC market.

(Credit : IC Insights)