The global semiconductor equipment market will get entrapped in a temporary hiccup in 2019, as chip makers will cut back, or freeze their capital spending to adjust their chip inventories or recalibrate their fabrication capacity, but in 2020 will skyrocket back to an all-time high, SEMI forecasts.

The SEMI forecast is in a sharp contrast with major bearish market forecast that the global chip market has already taken a down cycle through 2020. The forecsts reflect semiconductor equipment makers’ confidence in the future growth of global chip market, even if the equipment market has been slightly contracting in the past couple of months, suffering from drops in the orders from chip makers.

Although SEMI doesn’t identify why the organization is bullish about the post-2019 chip market, equipment makers have been echoing that the global IT industry's embrace of 5G technology will drive back up demand for memory chips and CPUs, as it will shape up a key technology-enabler for automotive driving, IoT and drones.

"We have just scratched the surface on Big Data Analytics market. As the 5G comes into our daily lives, data traffic will explode again, fueling enormously huge demand for chips of all kinds, “said senior director, corporate marketing with Rudolph Technologies.

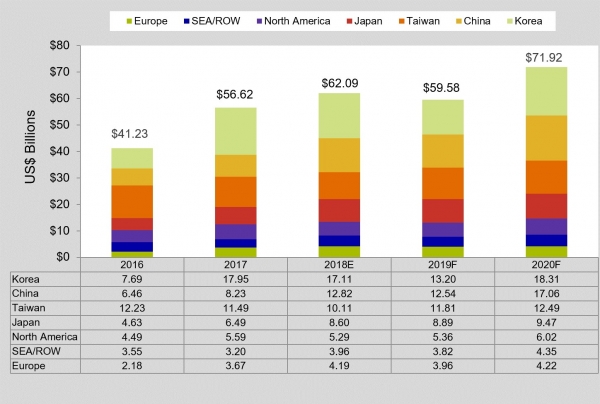

According to SEMI, worldwide shipments of semiconductor equipment will peak at US$62.1 billion in 2018, the highest on record, but would fall by about 4%, the first drop in years. Looking forward, however, the shipments will jump 20.7% year-on-year back to an all-time-high of US$71.9 billion in 2020.

A breakdown of the 2018 semiconductor equipment shipments by machine, shipments of front-end wafer processing equipment will jump by 10.2% to US$50.2 billion, while sales of fab utilities and wafer cooking and other accessory equipment like photo masks, reticles and pellicles will edge up 0.9% to US$2.5 billion. Sales of assembly & packaging equipment will edge up 1% to US$4.0 billion. Shipments of test equipment will surge by 15.6% to US$5.4 billion, as chip makers have invested more than before on the sophisticated testing equipment to screen out increasingly undetectable microscopic impurities or defects.

By country, Korea will still become the world’s largest capital spender in 2018, buying US$17.1 billion worth of equipment, but in 2019 Korean equipment market will significantly shrink to US$13.2 billion, as the world’s two largest memory chip makers will curb their CAPEX.